Why do finance teams swear by Excel?

What makes spreadsheets the most preferred software tool of finance teams? Three things, it turns out.

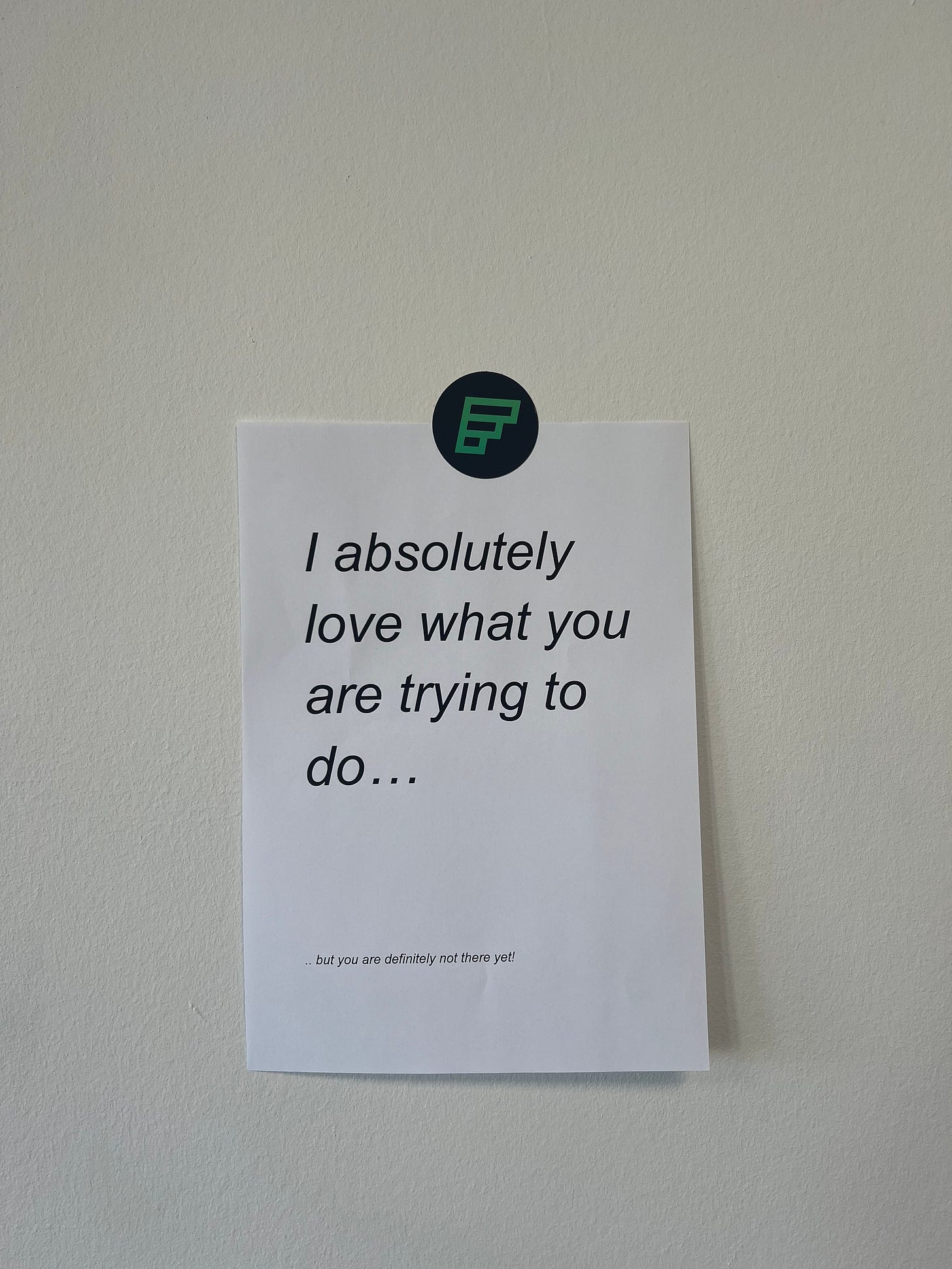

“I absolutely love what you’re trying to do…”

We tried to hide our smiles — awesome! Who doesn’t appreciate such positive feedback? Things were looking promising.

“... but you’re definitely not there yet!”

Ouch. Back to the drawing board.

That sales call took place in early 2023, with a Head of Finance commenting on our efforts to create a new type of spreadsheet - one purpose-built for financial planning.

But what exactly was the “there”? And why did he love it in the first place?

When we first set out to create an FP&A platform, we stumbled upon Packy McGormick’s piece, Excel Never Dies. It’s a remarkable article arguing that Excel has become the most influential software ever built. However, it also discusses the unbundling trend, where niche applications are developed for specific functions previously handled by Excel.

So, we wondered: With so many seemingly great FP&A solutions available, why do most finance teams still rely on Excel or Sheets?

From our early conversations, we discovered that most finance teams had indeed tried implementing new FP&A platforms. Lack of awareness wasn’t the issue. However, the vast majority eventually found themselves returning to their trusted spreadsheets.

So, what enables spreadsheets from the 1980s to outcompete Excel alternatives developed 40 years later? Why couldn’t modern software compete with seemingly primitive spreadsheets?

Through hundreds (yes, hundreds!) of conversations, we found that FP&A professionals love spreadsheets for three reasons:

Flexibility

Autonomy

Familiarity

1. Flexibility to build custom models

No two companies are the same. Their financial models differ, their general ledgers contain different accounts, and their teams have different understandings of FP&A.

One major issue that we discovered with existing solutions, was that they often tried to shoehorn diverse businesses with varying needs into a standardized, restrictive system.

However, finance teams require modeling flexibility. Any platform attempting to replace their current spreadsheet models must allow the same level of flexibility. Covering 90% of their modeling requirements simply won’t cut it for planning purposes.

With spreadsheets, finance teams have become accustomed to unlimited flexibility. If you throw enough time, VLOOKUPs and VBA at your model, anything is possible within the world of spreadsheets. Also, no board member will ever be satisfied with the excuse: “Sorry, our new FP&A platform doesn’t allow me to model our new loan structure.”

The caveat? You’ll need to build the entire system yourself. More on this in a future post.

2. Avoid dependency on outside resources

Finance is accountable for the accuracy and timeliness of numbers, so relying on outside resources is a business risk.

Finance teams have spent significant time learning the ins and outs of Excel or Sheets: structuring models, transforming data, building reports, mastering shortcuts, and much more. They rely on familiar grid layouts and formula syntax to develop sophisticated analyses and keep up with their business's ever-changing environment. When relying on spreadsheets, the finance team’s time is the only scarce resource. While it's admittedly under pressure, it's within their control.

Being comfortable implementing, managing, and restructuring your tools and systems is critical across all departments — including finance. However, most “modern” FP&A platforms add complexity far exceeding traditional spreadsheets. They often require upskilling of the finance team, more technical profiles, or vendor dependency. No board member is satisfied with “A new forecast? Sure, I’ll put in a ticket with our developers and get back to you next quarter.”

3. Ease of use for everyone

Equally important, the finance team must collaborate with the rest of the organization, especially for planning purposes. Having a platform that is easy for non-finance stakeholders to use is critical.

Why would teams invest time and effort in learning a new tool when everyone is proficient with spreadsheets? Everyone knows how to use a spreadsheet; tool fatigue is a major pain.

Conclusion

Now, with this information, we’ve concluded that your finance team will stick to Excel or Sheets until an FP&A platform emerges that:

is flexible enough for your finance team to replicate their spreadsheet models 1:1 without compromising flexibility.

enables your finance team to confidently develop, maintain, and restructure their models without needing technical support or external consultants.

is intuitive enough for non-finance colleagues to navigate immediately.

So, how does all of this relate to the prospect at the beginning of this post? While the prospect appreciated the familiarity of our platform, he needed more flexibility to replicate his Excel model. Since then, we've worked to close that gap.

P.S. We printed that customer quote and hung it in our office as a reminder to keep our eyes on the ball.